Health Insurance

Goal

Redesign the health insurance journey to reduce drop-offs and improve quote conversion rates.

Role

UX & UI Designer

Role

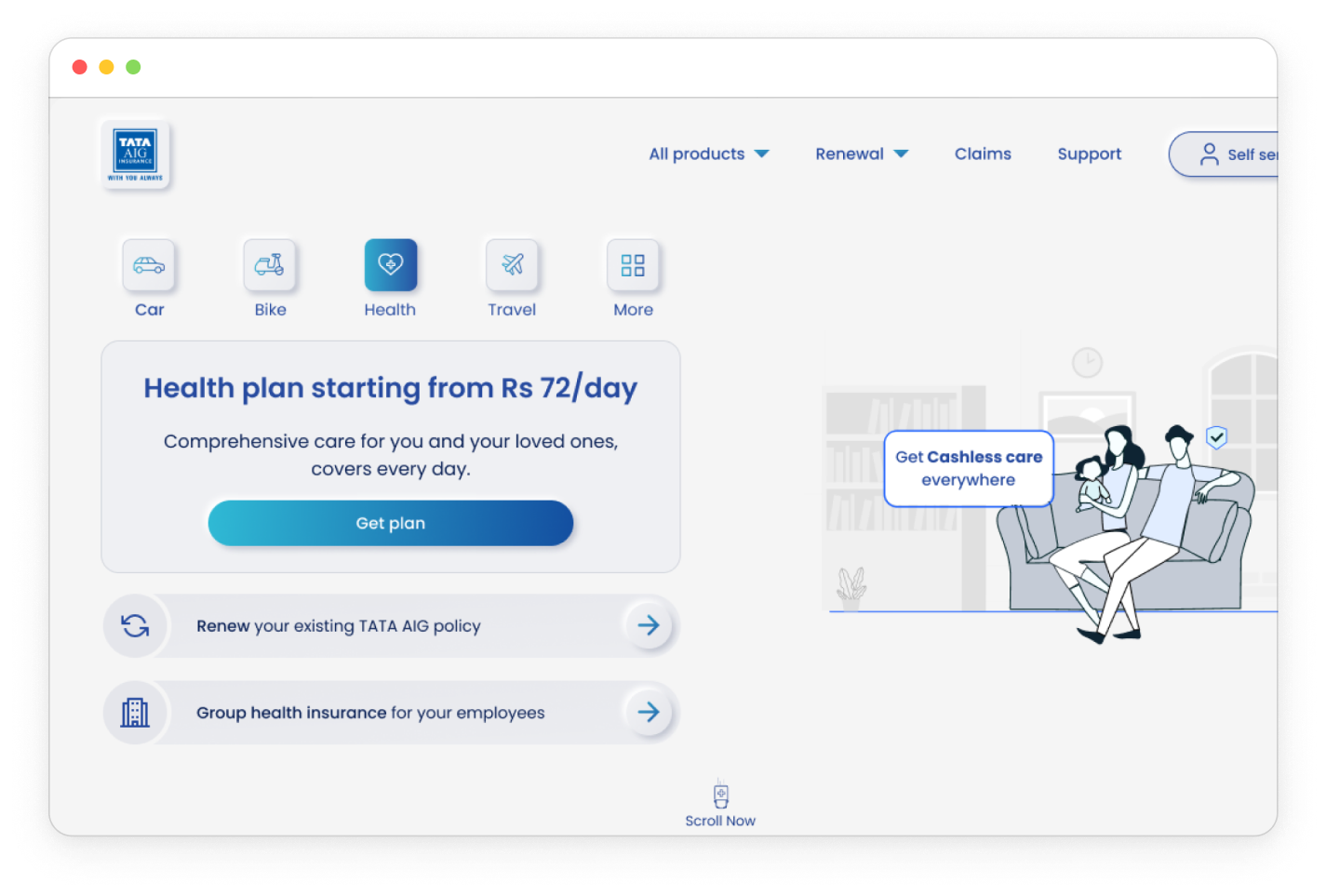

TATA AIG

Timeline

Oct 2024 – May 2025

🧩 Overview

India’s health insurance market is complex, with high user drop-offs and low trust in digital journeys. This project focused on rethinking the purchase experience — making it simpler, more human, and guided.

Impace I Brought

✔️ Created a more intuitive, intent-driven flow

✔️ Improved quote page engagement

✔️ Reduced user anxiety around form-filling

🔍 The Problem

So here’s the problem . . .

Despite a functional flow, the health insurance journey suffered from:

- High drop-offs before quote generation.

- User confusion around complex insurance terminology.

- A lack of decision support during plan selection.

“Users don’t understand the product, feel lost in the flow, and drop off before getting to the quote.”

Process being followed

Initial Insights

- Stakeholder Inputs

- Problem Statement

UX Research

- Existing design analysis

- Competitive Analysis

- Direct Interviews

Ideation & Feedback

- Wire-framing MVP

- Stakeholder Feedback

- Technical Feasibility Check

Design & Testing

- UI Design

- Internal Review

- Stakeholder Review

- Usability Testing

- Dev Handover

Iterations

Post-launch

🧠 Research Approach

Initial Insights

Adobe Analytics

Users were exiting at CKYC and communication steps.

Focus Group Discussions

Users felt overwhelmed by jargon and long forms.

Competitor Check

Platforms like ACKO and Lemonade offered simplified flows and real-time help.

Usability Check

Conducted usability testing with Care Insurance; Also, compared with Acko, Care, Argo, Lombard, +4.

Insights

- Testing: High Drop-offs at Data-Heavy or Sensitive Steps; Lack of Guidance Hampers Decision-Making

- Competitive analysis: Live chat, user education, & reducing cognitive load.

Visible in desktop mode

Direct User Interviews

Conducted 1:1 sessions with 8 potential buyers (18–34 yrs, Tier 1 & 2 cities).

Insights

- Unclear policy language and lack of trust.

- Highlighting the value of human support in building trust and clarity during the purchase journey.

💡 Ideation & MVP

Inspired by global UX leaders like Lemonade and Insurify.

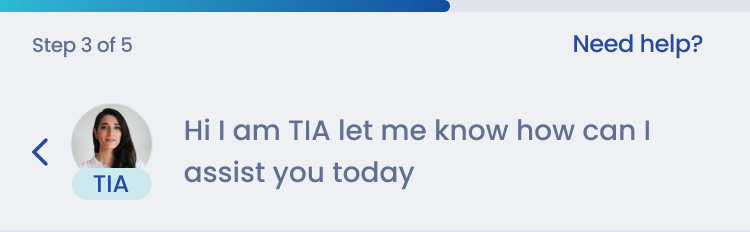

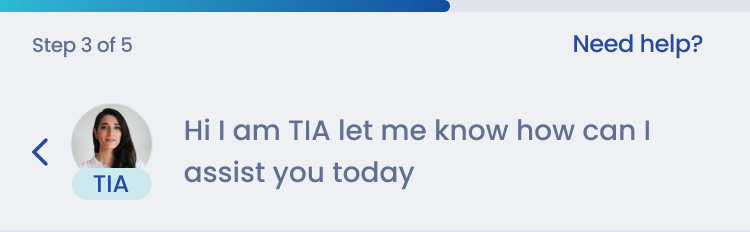

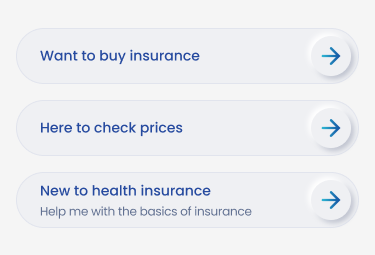

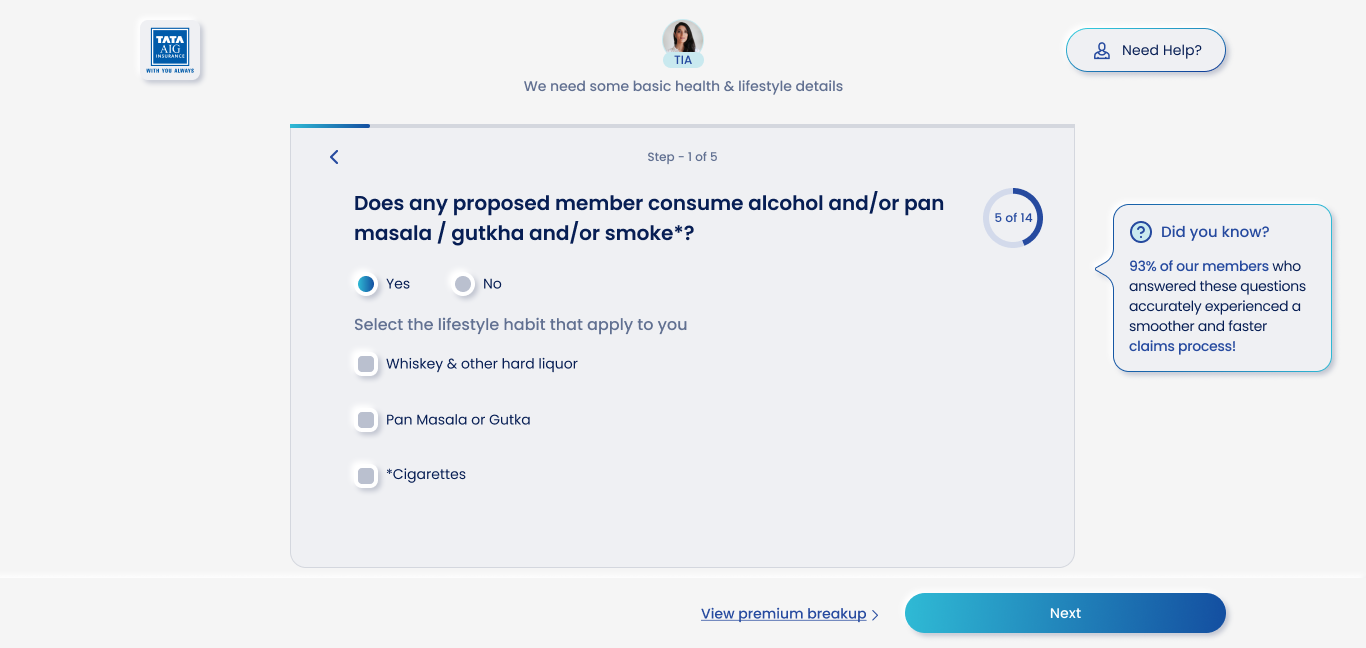

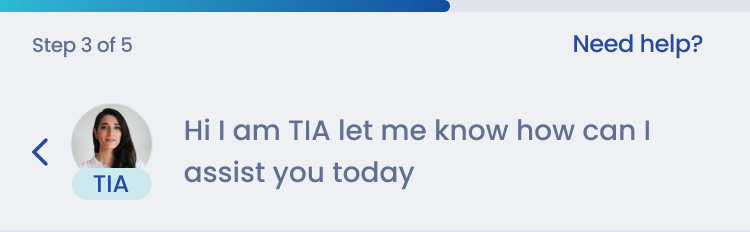

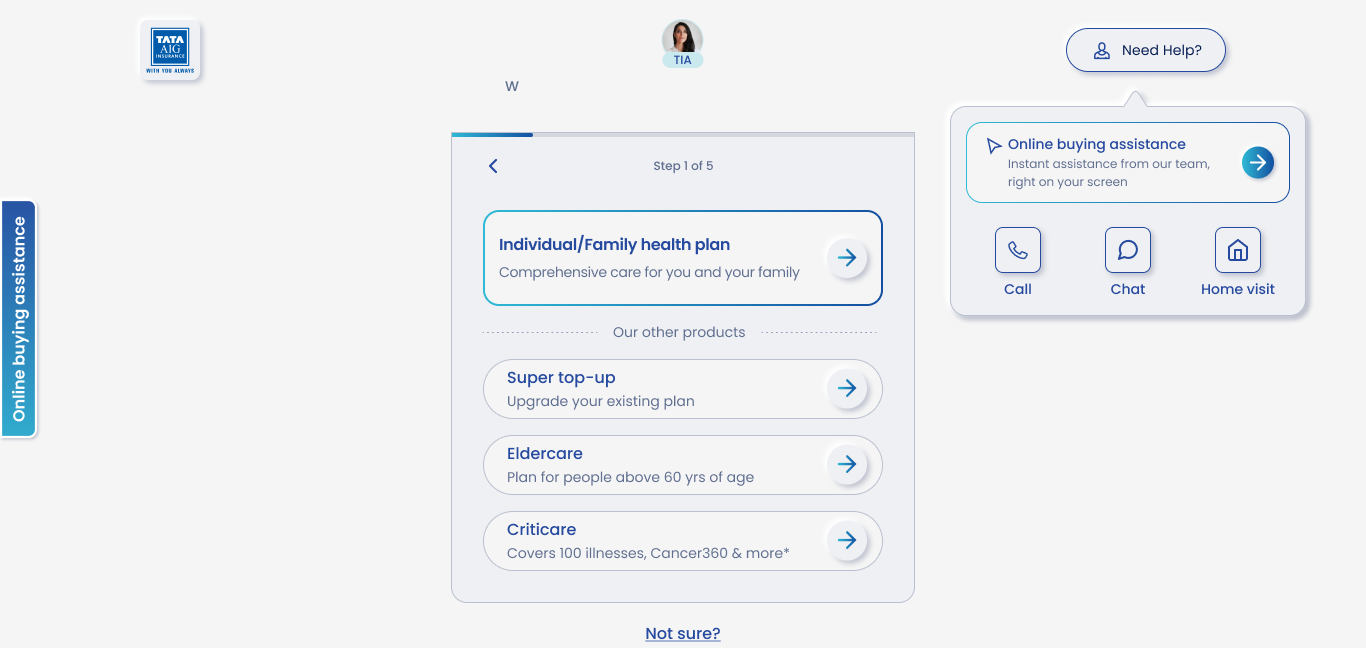

Introduced TIA

TIA (Chatbot) was introduced to serve as a smart, supportive companion along the journey—offering pre-defined guidance, exactly when users need it.

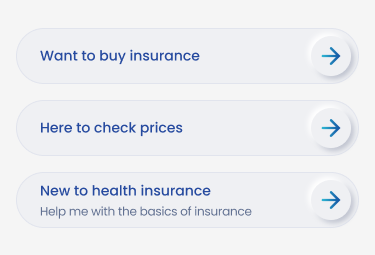

Intent-Based Journeys

Intent-based paths—some wants to explore, others compare, and a few ready to buy, ensures each user gets relevant content, pacing, and support

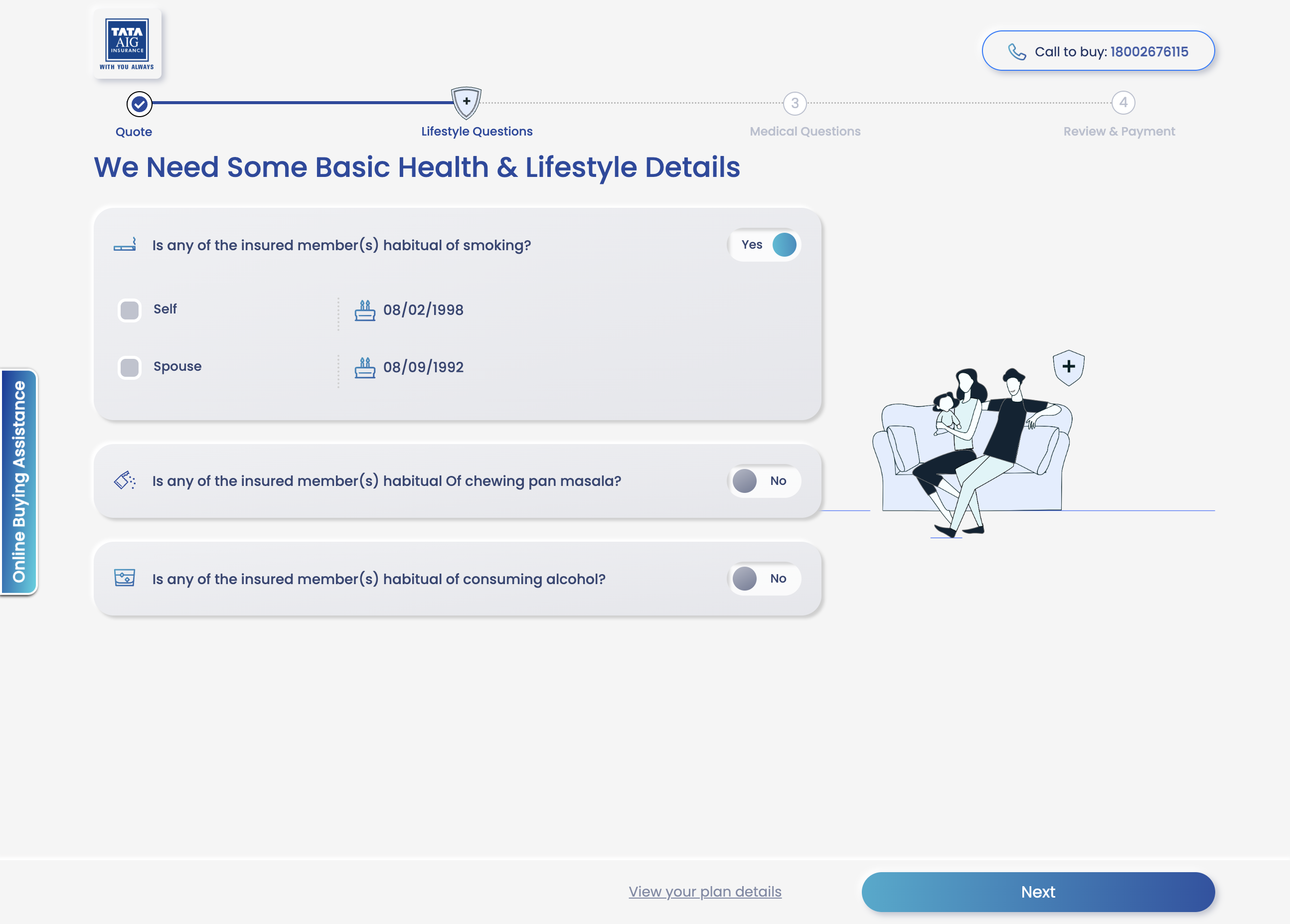

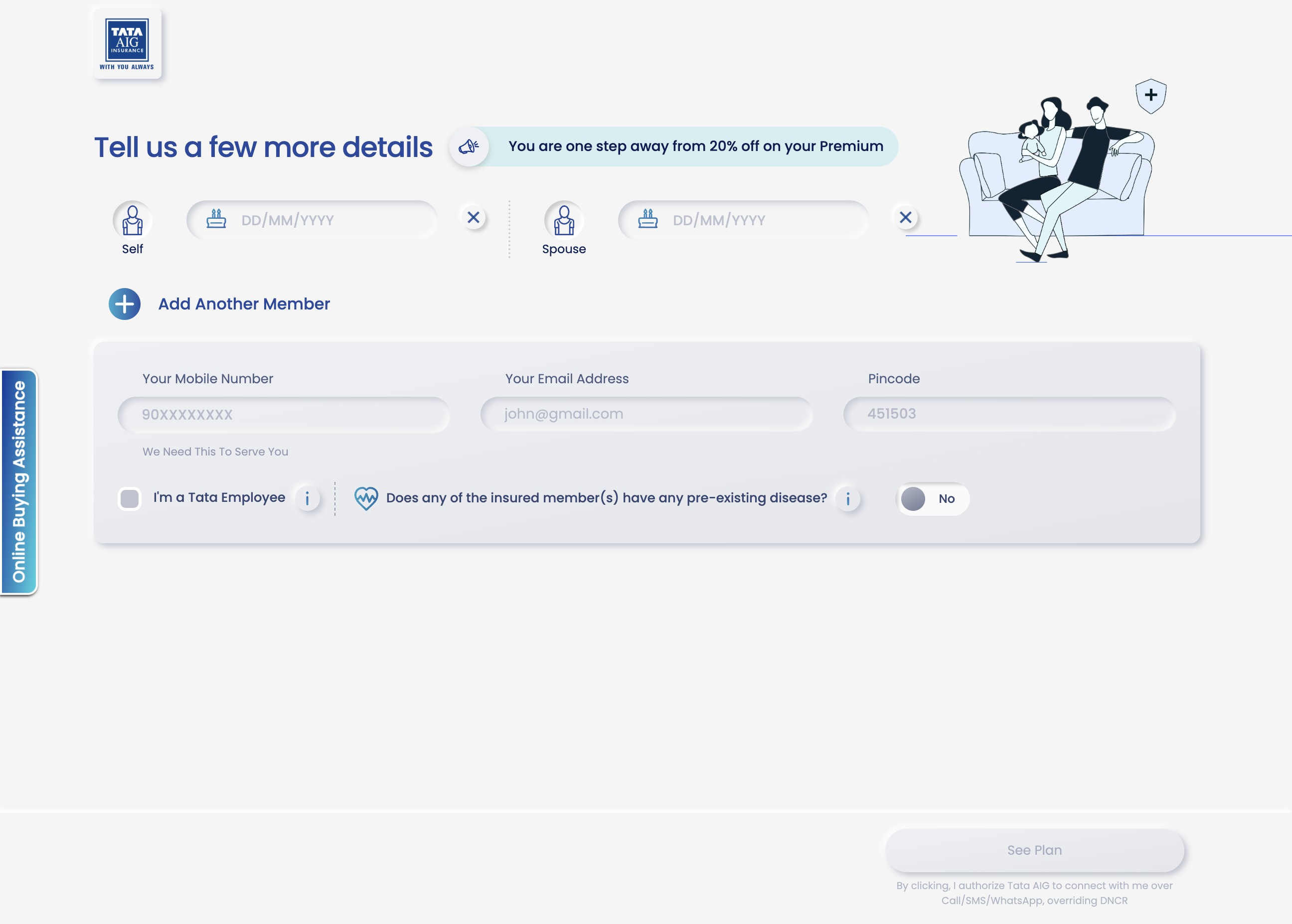

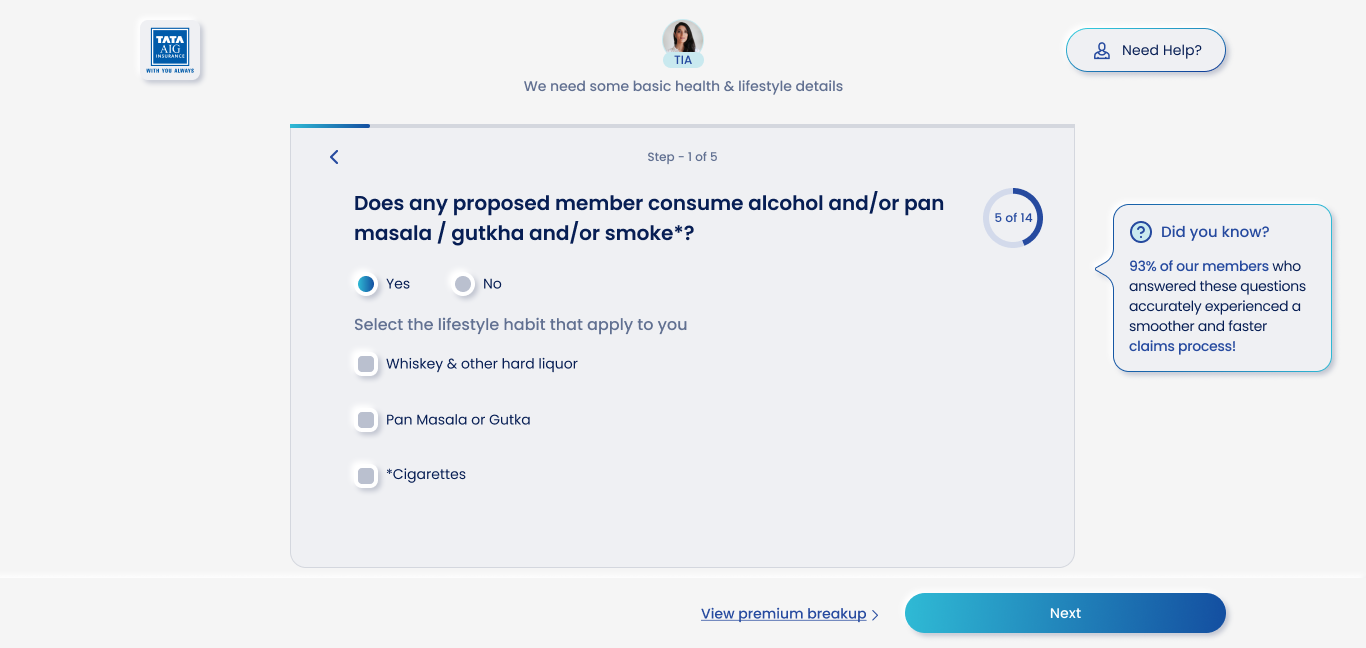

Simplified Pre-Quote Inputs

To reduce friction and mental overload, the pre-quote process was restructured into bite-sized, sequential steps—making it feel faster, clearer, and easier to complete.

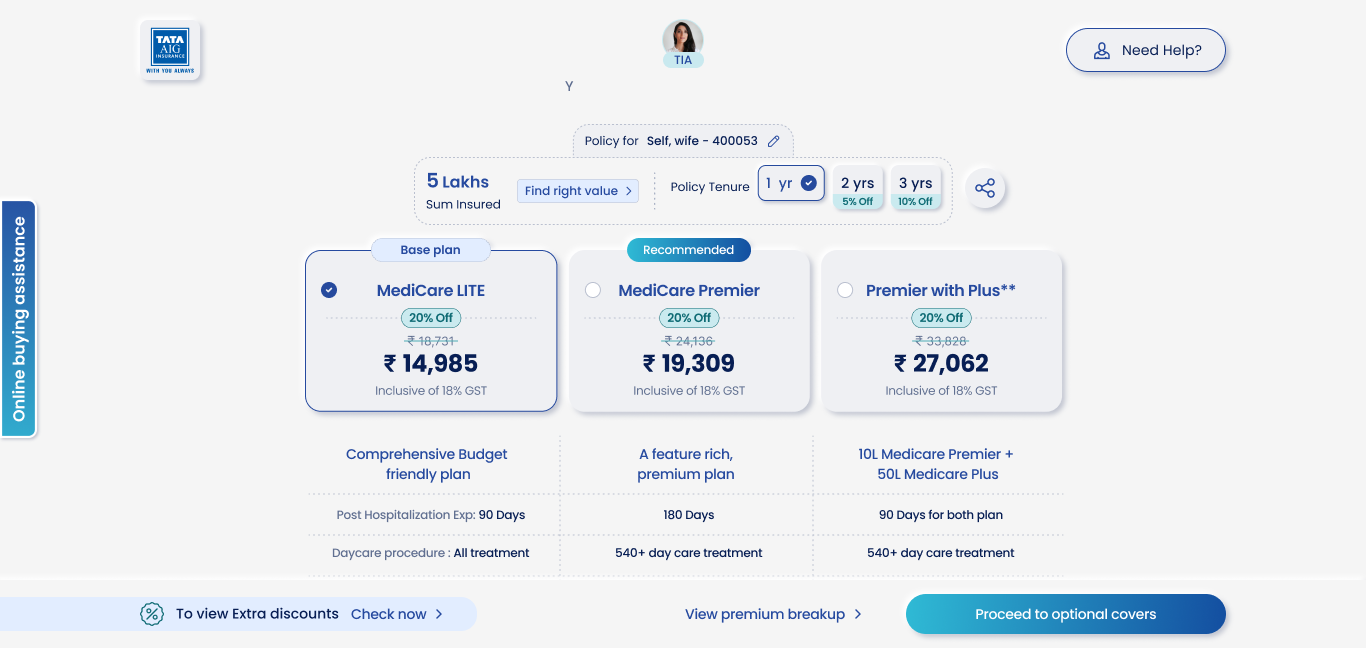

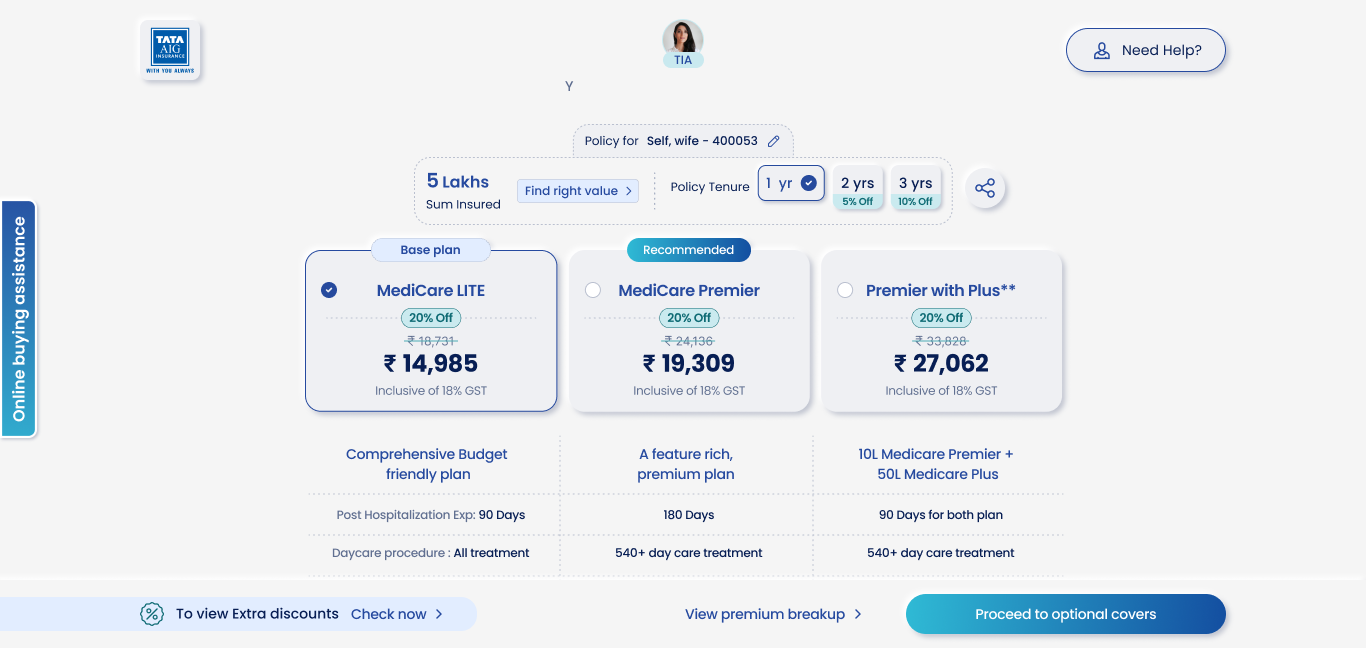

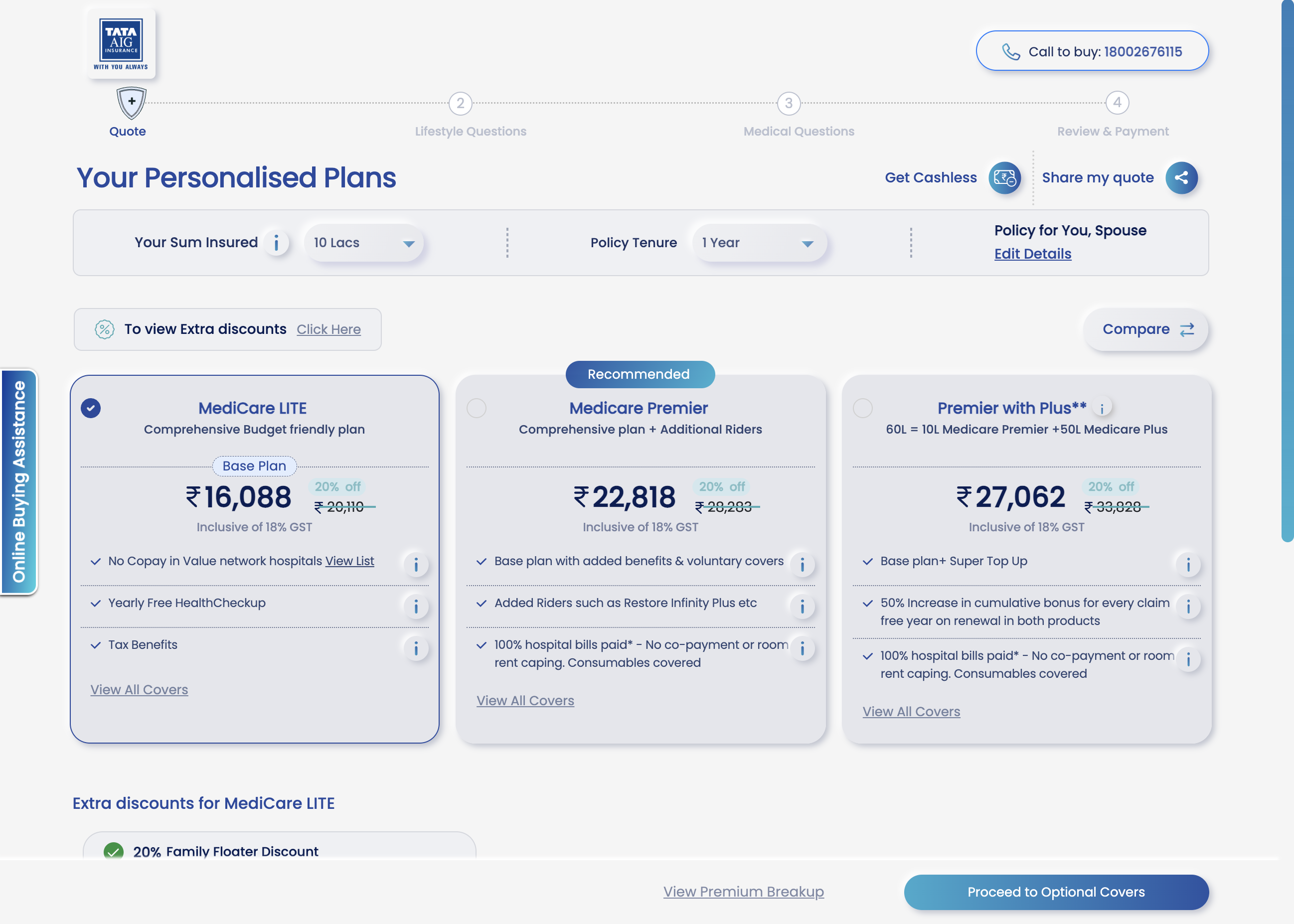

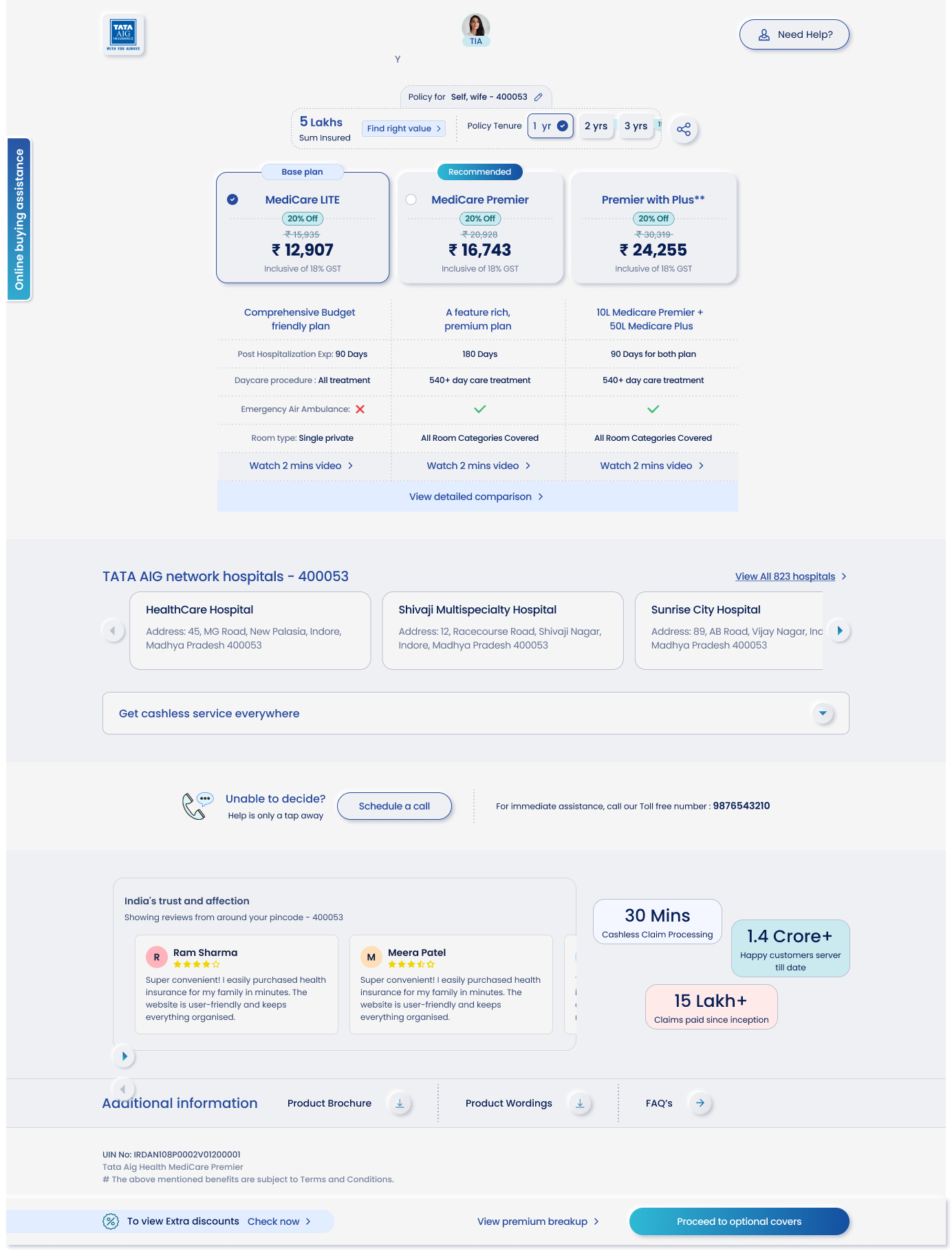

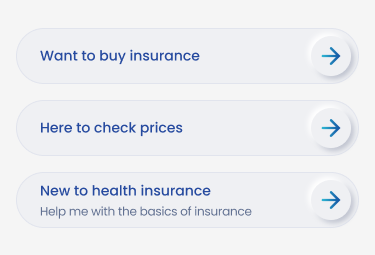

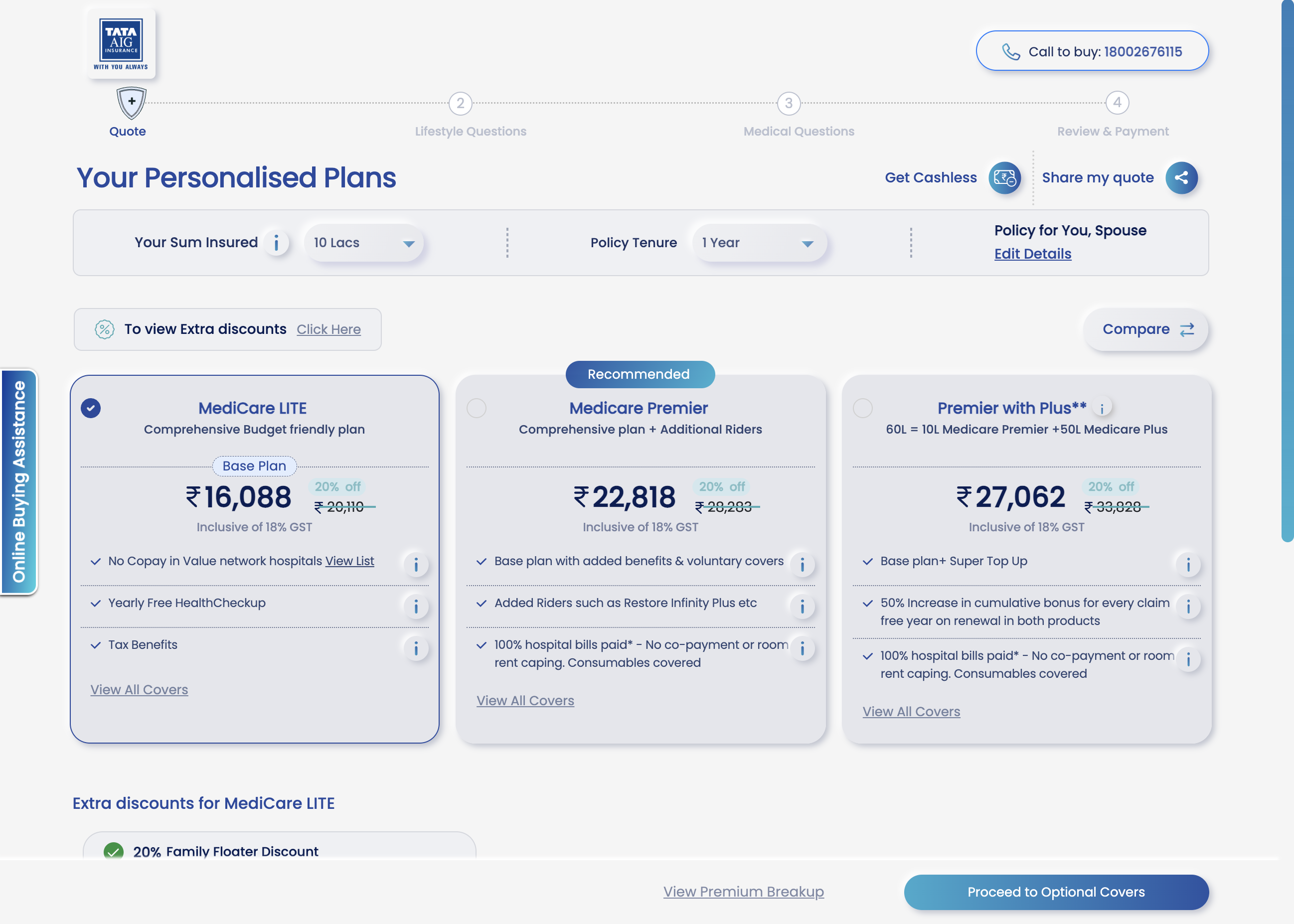

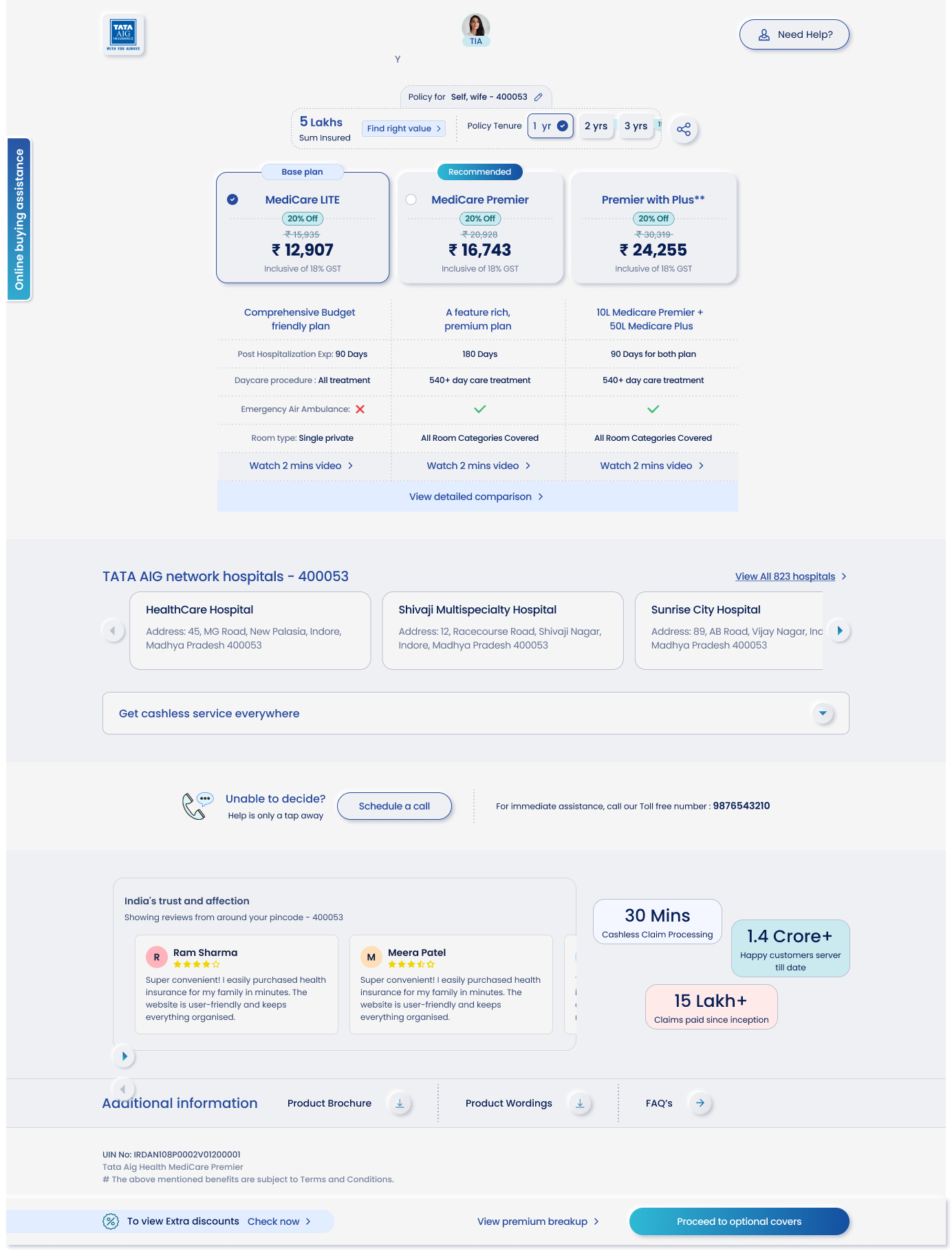

Enhanced Quote Page

Improved the quote page for better comprehension, easier comparison, and clearer feature distinctions.

Next Step . . .

Wire-framing MVP

After analyzing user pain points, we drew inspiration from user-centric foreign websites like Lemonade, Insurify, and Ladder Life. Our POC focused on 4 key areas.

Stakeholder Feedback

Presented MVP wireframes to Product Managers and key stakeholders for initial feedback and alignment.

Technical Feasibility Check

Collaborated with the development team to evaluate the feasibility of proposed features and flows.

🧪 Design + Testing

Usability Testing (8 users):

- Desktop (6), Mobile (2)

- Feedback on navigation, data privacy, and comparison friction

🔧 Improvements Made

Nominee/Member edits unclear

Clarified with icons and labels

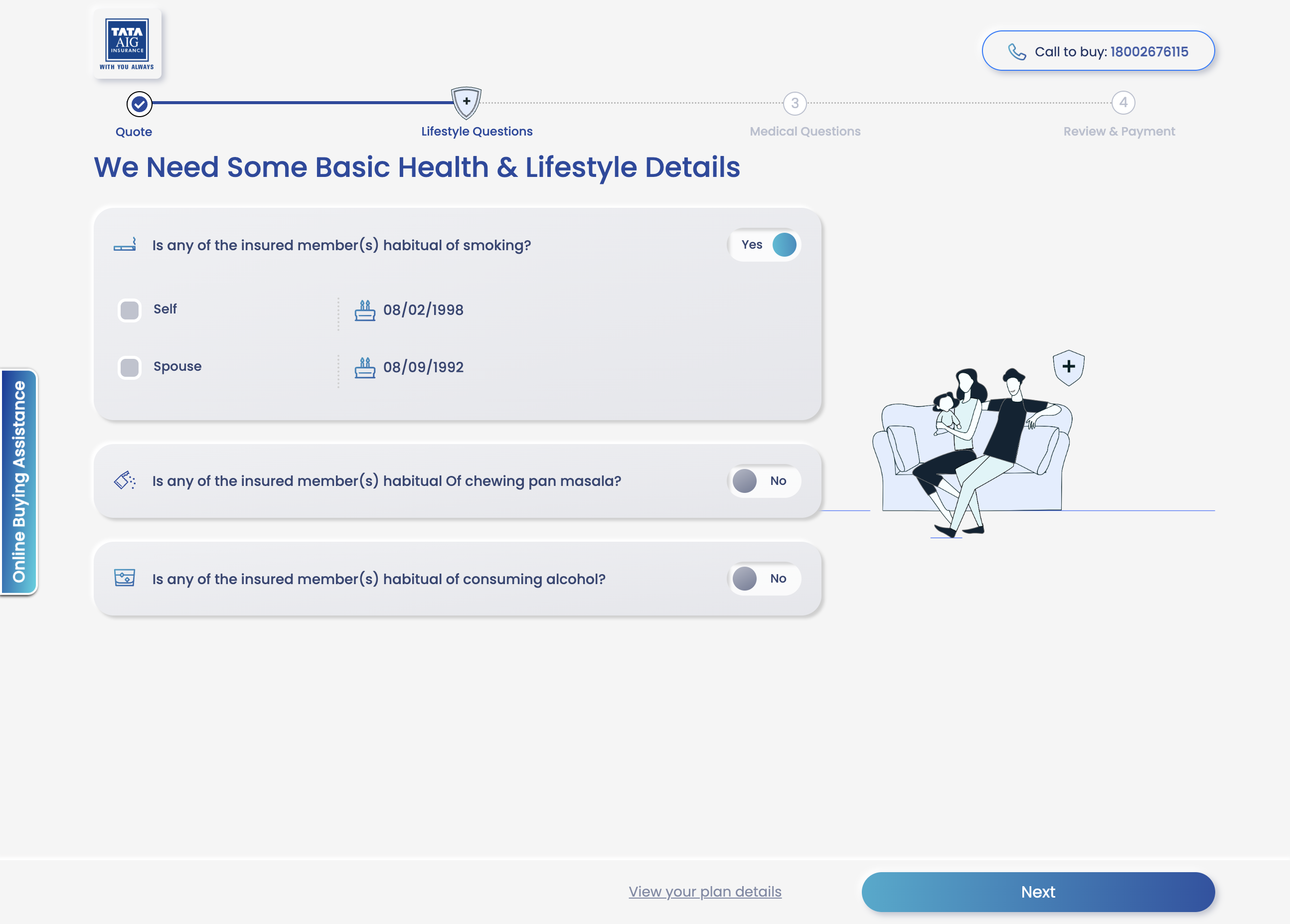

Confusing flow

Added progress bar and back buttons

Plan comparison hard

Simplified UI with clear hierarchy & videos

Privacy anxiety

Added micro-copy and delay personal data entry

✨ Before → After

Visible in desktop mode

📈 Post-launch Validation

Quantitative Metrics

Tracks user behavior at scale — drop-offs, time spent, click-throughs, conversion rates — to establish baseline performance and surface friction points.

Qualitative Feedback

Provides heatmaps, scroll tracking, session replays, and quick surveys to capture how users interact with the new journey and where attention or confusion lies.

Behavioral Validation

Live 1:1 sessions will help us understand user mindset, navigation ease, and clarity of plan comprehension — validating the design at a human level.

Chandra Kumar Deo

Health Insurance

Redesign the health insurance journey to reduce drop-offs and improve quote conversion rates.

Role:

UX & UI Designer

Client:

TATA AIG

Timeline:

Oct 2024 – May 2025

🧩 Overview

India’s health insurance market is complex, with high user drop-offs and low trust in digital journeys. This project focused on rethinking the purchase experience — making it simpler, more human, and guided.

Impace I Brought

✔️ Created a more intuitive, intent-driven flow

✔️ Improved quote page engagement

✔️ Reduced user anxiety around form-filling

🔍 The Problem

So here’s the problem . . .

Despite a functional flow, the health insurance journey suffered from:

- High drop-offs before quote generation.

- User confusion around complex insurance terminology.

- A lack of decision support during plan selection.

“Users don’t understand the product, feel lost in the flow, and drop off before getting to the quote.”

Process being followed

Initial Insights

- Stakeholder Inputs

- Problem Statement

UX Research

- Existing design analysis

- Competitive Analysis

- Direct Interviews

Ideation & Feedback

- Wire-framing MVP

- Stakeholder Feedback

- Technical Feasibility Check

Design & Testing

- UI Design

- Internal Review

- Stakeholder Review

- Usability Testing

- Dev Handover

Iterations

Post-launch

🧠 Research Approach

Initial Insights

Adobe Analytics

Users were exiting at CKYC and communication steps.

Focus Group Discussions

Users felt overwhelmed by jargon and long forms.

Competitor Check

Platforms like ACKO and Lemonade offered simplified flows and real-time help.

Usability Check

Conducted usability testing with Care Insurance; Also, compared with Acko, Care, Argo, Lombard, +4.

Insights

- Testing: High Drop-offs at Data-Heavy or Sensitive Steps; Lack of Guidance Hampers Decision-Making

- Competitive analysis: Live chat, user education, & reducing cognitive load.

Research Flow

Direct User Interviews

Conducted 1:1 sessions with 8 potential buyers (18–34 yrs, Tier 1 & 2 cities).

Insights

- Unclear policy language and lack of trust.

- Highlighting the value of human support in building trust and clarity during the purchase journey.

💡 Ideation & MVP

Inspired by global UX leaders like Lemonade and Insurify.

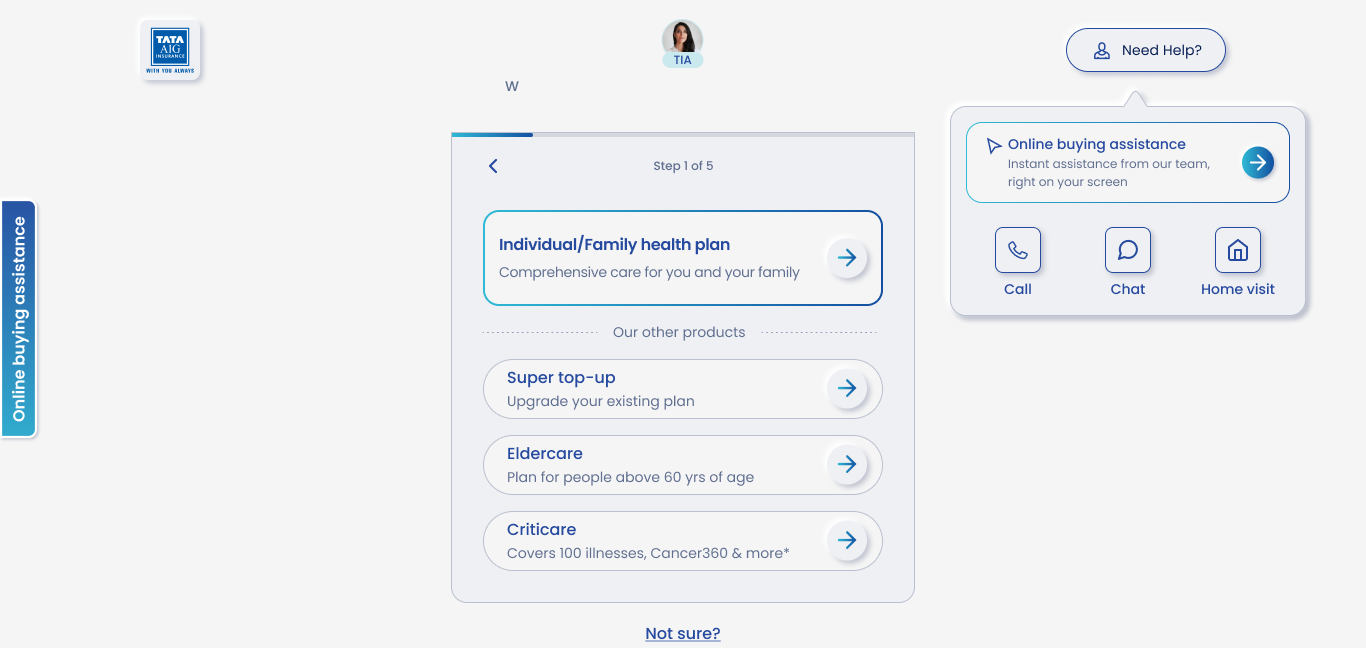

Introduced TIA

TIA (Chatbot) was introduced to serve as a smart, supportive companion along the journey—offering pre-defined guidance, exactly when users need it.

Intent-Based Journeys

Intent-based paths—some wants to explore, others compare, and a few ready to buy, ensures each user gets relevant content, pacing, and support

Simplified Pre-Quote Inputs

To reduce friction and mental overload, the pre-quote process was restructured into bite-sized, sequential steps—making it feel faster, clearer, and easier to complete.

Enhanced Quote Page

Improved the quote page for better comprehension, easier comparison, and clearer feature distinctions.

Next Step . . .

Wire-framing MVP

After analyzing user pain points, we drew inspiration from user-centric foreign websites like Lemonade, Insurify, and Ladder Life. Our POC focused on 4 key areas.

Stakeholder Feedback

Presented MVP wireframes to Product Managers and key stakeholders for initial feedback and alignment.

Technical Feasibility Check

Collaborated with the development team to evaluate the feasibility of proposed features and flows.

🧪 Design + Testing

Usability Testing (8 users):

- Desktop (6), Mobile (2)

- Feedback on navigation, data privacy, and comparison friction

🔧 Improvements Made

Nominee/Member edits unclear

Clarified with icons and labels

Confusing flow

Added progress bar and back buttons

Plan comparison hard

Simplified UI with clear hierarchy & videos

Privacy anxiety

Added micro-copy and delay personal data entry

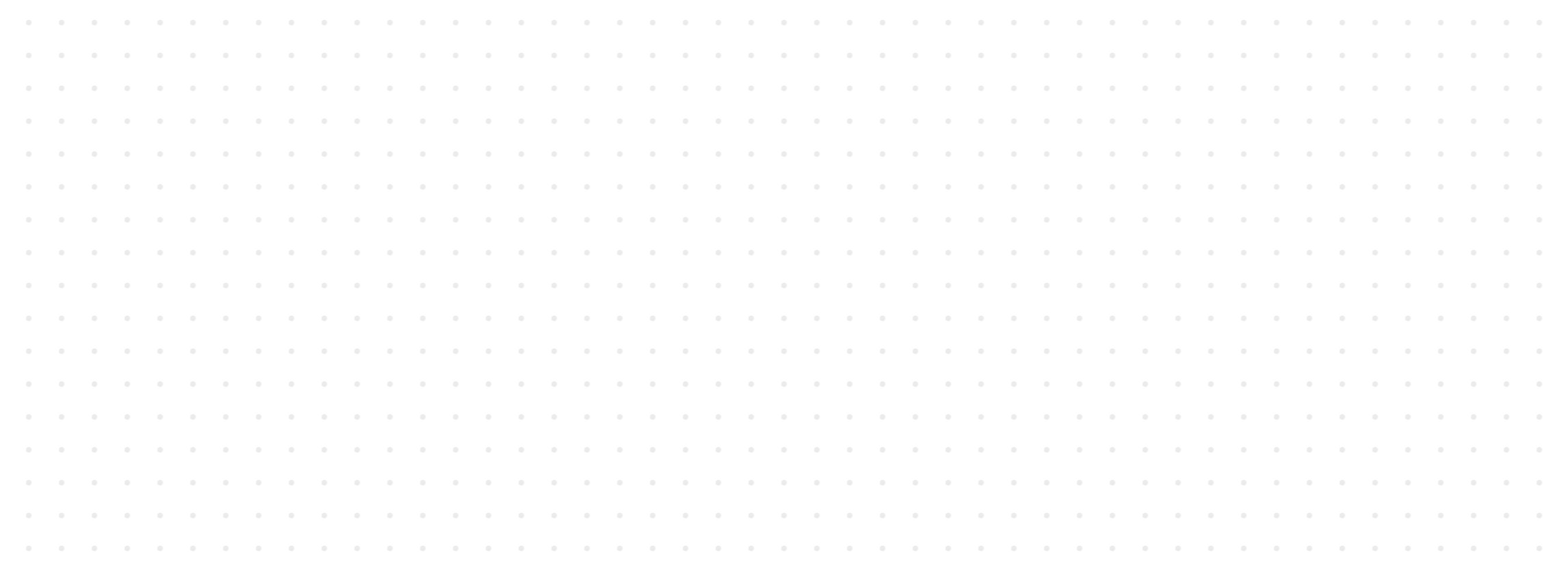

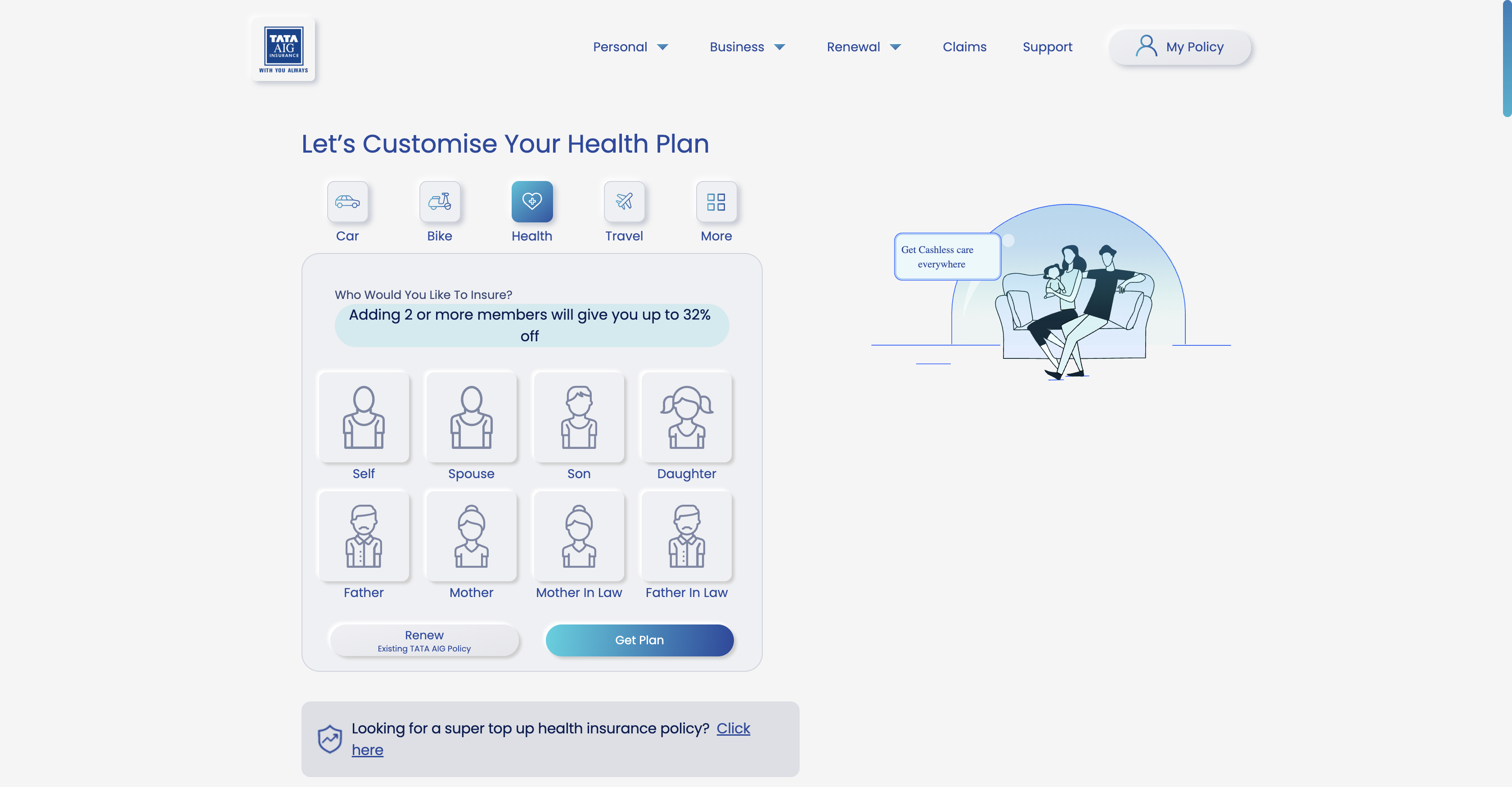

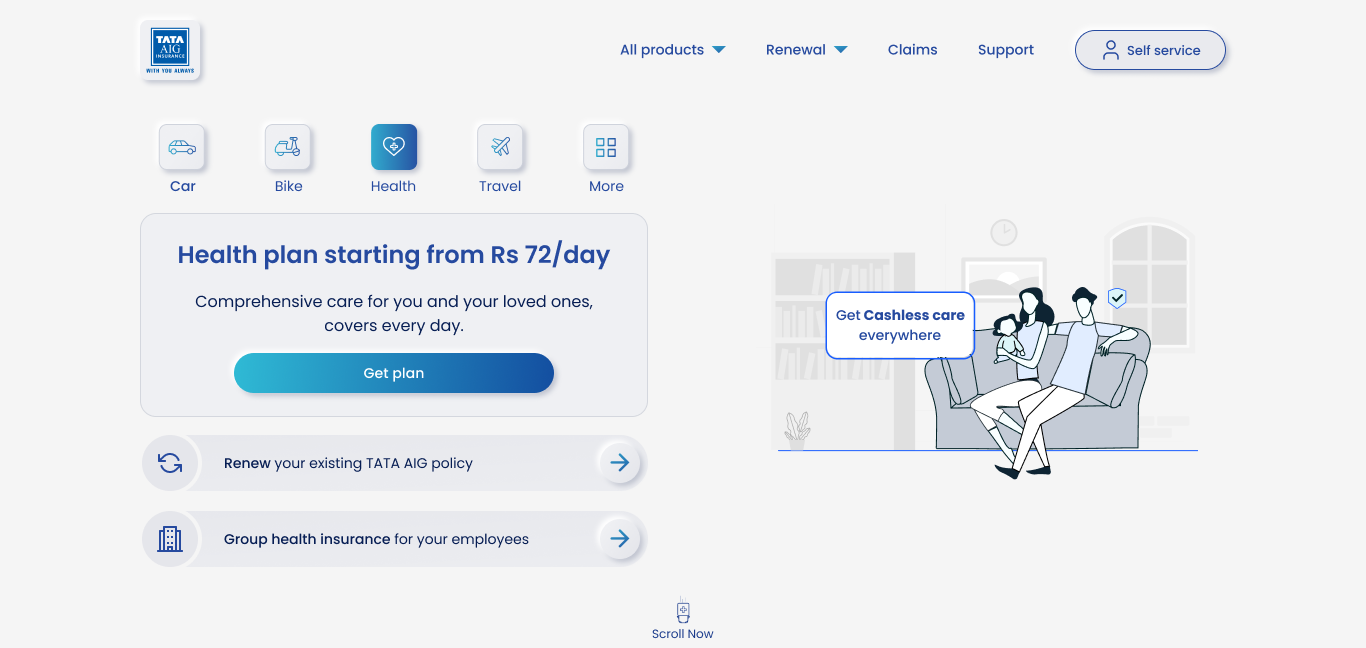

✨ Before → After

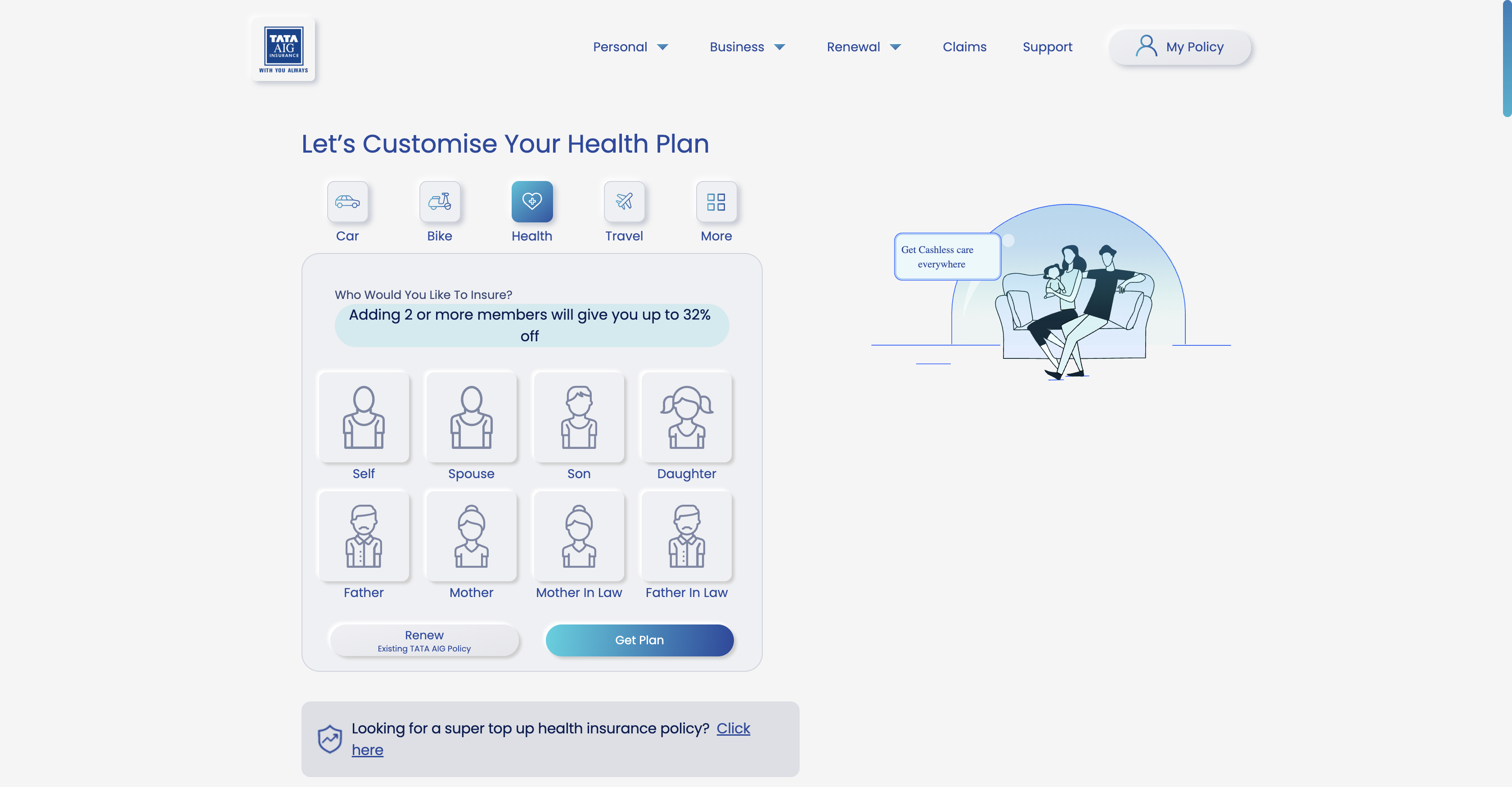

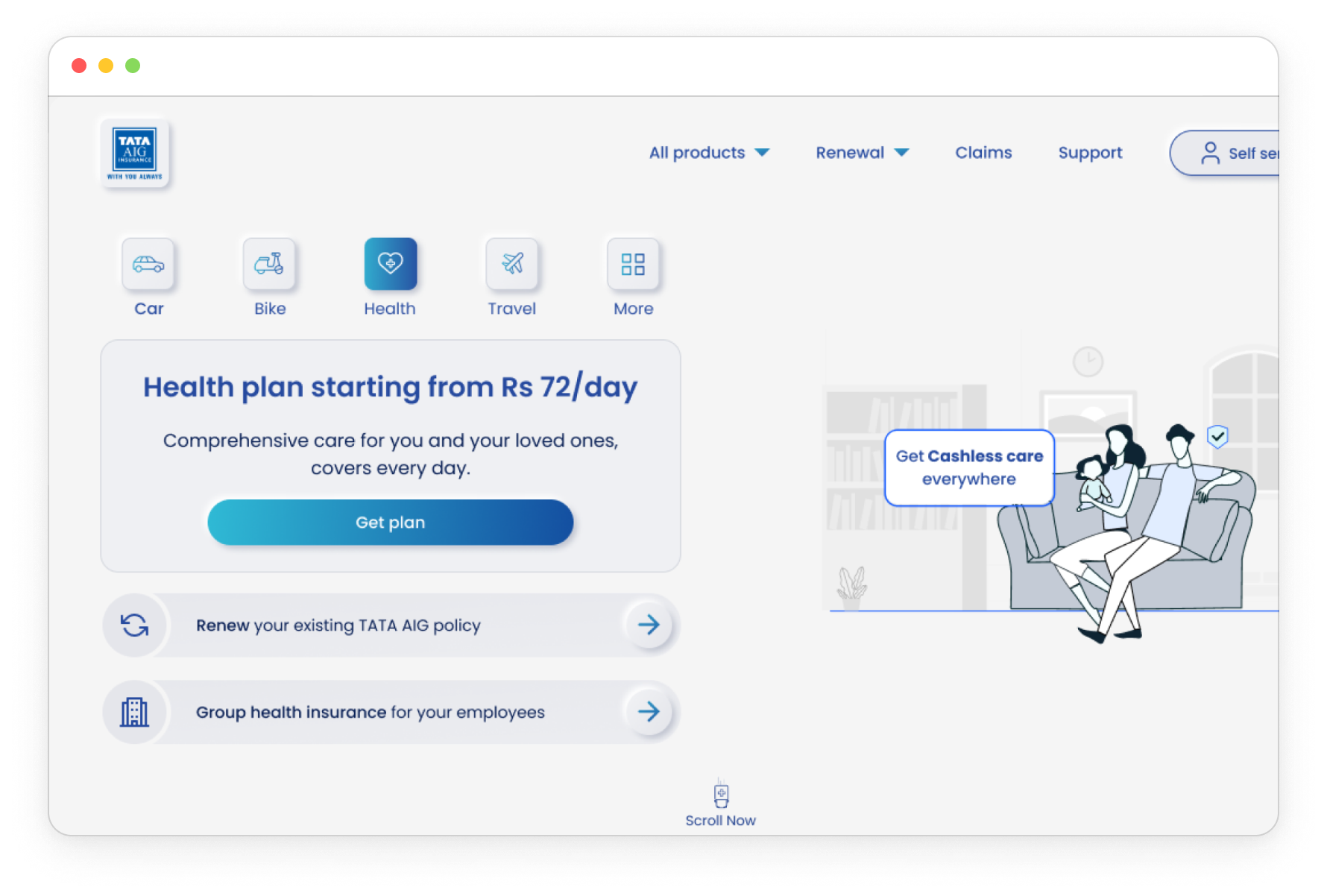

❌ Journey started without understanding user intent

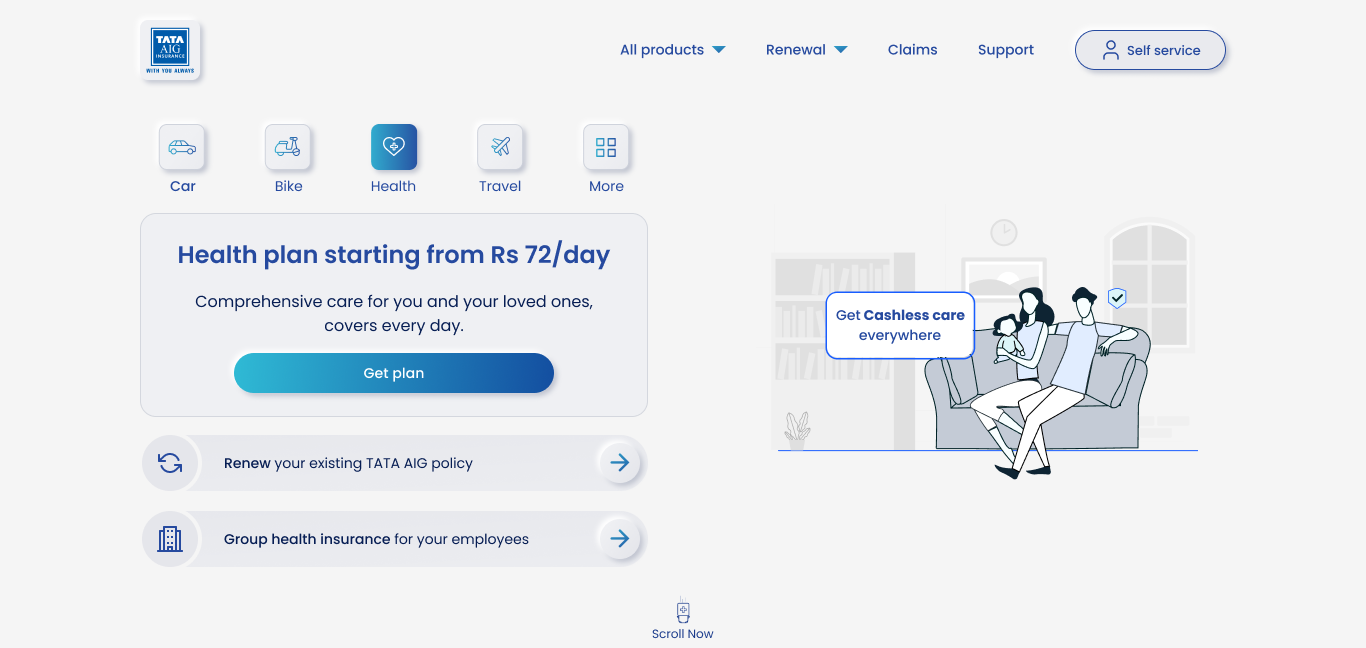

✅ Primary CTA clearly highlighted

❌ Multiple CTAs caused decision fatigue

✅ Simplified screen with focused actions

❌ Member selection forced upfront

✅ Clear support options via TIA and help panel

✅ Guided, step-by-step journey introduced

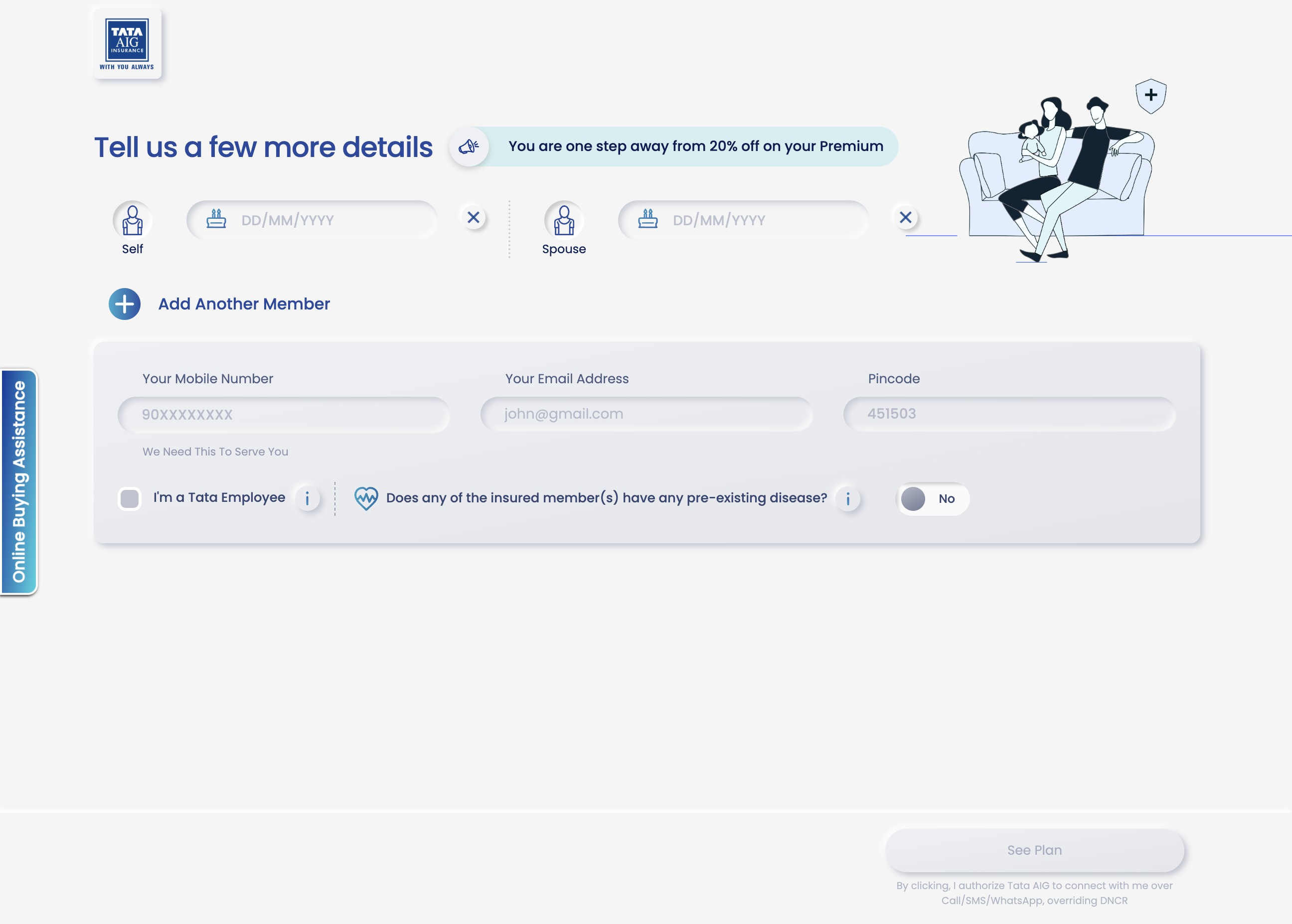

❌ Cluttered screen with too many input fields upfront

❌ Overwhelming form-like experience

✅ Intent-based entry with plan type upfront

✅ Cleaner layout with primary action and visual hierarchy

✅ Plans simplified with clear naming and key benefits upfront

❌ Premium info scattered and visually heavy

❌ Overloaded UI with multiple CTAs (e.g., “Compare”, “Proceed”, “View All Covers”)

✅ Added short explainer videos and focused comparison options

✅ Progress indicator added to show journey stage

✅ Plans simplified with clear naming and key benefits upfront

❌ Multiple questions at once increase make it overwhelming for the users

❌ Overloaded UI with multiple CTAs (e.g., “Compare”, “Proceed”, “View All Covers”)

✅ Contextual help icon with reassurance messaging (e.g., claim accuracy stat)

Visit Page

[1/4]

📈 Post-launch Validation

Quantitative Metrics

Tracks user behavior at scale — drop-offs, time spent, click-throughs, conversion rates — to establish baseline performance and surface friction points.

Qualitative Feedback

Provides heatmaps, scroll tracking, session replays, and quick surveys to capture how users interact with the new journey and where attention or confusion lies.

Behavioral Validation

Live 1:1 sessions will help us understand user mindset, navigation ease, and clarity of plan comprehension — validating the design at a human level.

Health Insurance

Goal:

Redesign the health insurance journey to reduce drop-offs and improve quote conversion rates.

Role:

UX & UI Designer

Client:

TATA AIG

Timeline:

Oct 2024 – May 2025

🧩 Overview

India’s health insurance market is complex, with high user drop-offs and low trust in digital journeys. This project focused on rethinking the purchase experience — making it simpler, more human, and guided.

Impace I Brought

✔️ Created a more intuitive, intent-driven flow

✔️ Improved quote page engagement

✔️ Reduced user anxiety around form-filling

🔍 The Problem

So here’s the problem . . .

Despite a functional flow, the health insurance journey suffered from:

- High drop-offs before quote generation.

- User confusion around complex insurance terminology.

- A lack of decision support during plan selection.

“Users don’t understand the product, feel lost in the flow, and drop off before getting to the quote.”

Process being followed

Initial Insights

- Stakeholder Inputs

- Problem Statement

UX Research

- Existing design analysis

- Competitive Analysis

- Direct Interviews

Ideation & Feedback

- Wire-framing MVP

- Stakeholder Feedback

- Technical Feasibility Check

Design & Testing

- UI Design

- Internal Review

- Stakeholder Review

- Usability Testing

- Dev Handover

Iterations

Post-launch

🧠 Research Approach

Initial Insights

Adobe Analytics

Users were exiting at CKYC and communication steps.

Focus Group Discussions

Users felt overwhelmed by jargon and long forms.

Competitor Check

Platforms like ACKO and Lemonade offered simplified flows and real-time help.

Usability Check

Conducted usability testing with Care Insurance; Also, compared with Acko, Care, Argo, Lombard, +4.

Insights

- Testing: High Drop-offs at Data-Heavy or Sensitive Steps; Lack of Guidance Hampers Decision-Making

- Competitive analysis: Live chat, user education, & reducing cognitive load.

Research Flow

Direct User Interviews

Conducted 1:1 sessions with 8 potential buyers (18–34 yrs, Tier 1 & 2 cities).

Insights

- Unclear policy language and lack of trust.

- Highlighting the value of human support in building trust and clarity during the purchase journey.

💡 Ideation & MVP

Inspired by global UX leaders like Lemonade and Insurify.

Introduced TIA

TIA (Chatbot) was introduced to serve as a smart, supportive companion along the journey—offering pre-defined guidance, exactly when users need it.

Intent-Based Journeys

Intent-based paths—some wants to explore, others compare, and a few ready to buy, ensures each user gets relevant content, pacing, and support

Simplified Pre-Quote Inputs

To reduce friction and mental overload, the pre-quote process was restructured into bite-sized, sequential steps—making it feel faster, clearer, and easier to complete.

Enhanced Quote Page

Improved the quote page for better comprehension, easier comparison, and clearer feature distinctions.

Next Step . . .

Wire-framing MVP

After analyzing user pain points, we drew inspiration from user-centric foreign websites like Lemonade, Insurify, and Ladder Life. Our POC focused on 4 key areas.

Stakeholder Feedback

Presented MVP wireframes to Product Managers and key stakeholders for initial feedback and alignment.

Technical Feasibility Check

Collaborated with the development team to evaluate the feasibility of proposed features and flows.

🧪 Design + Testing

Usability Testing (8 users):

- Desktop (6), Mobile (2)

- Feedback on navigation, data privacy, and comparison friction

🔧 Improvements Made

Nominee/Member edits unclear

Clarified with icons and labels

Confusing flow

Added progress bar and back buttons

Plan comparison hard

Simplified UI with clear hierarchy & videos

Privacy anxiety

Added micro-copy and delay personal data entry

✨ Before → After

❌ Journey started without understanding user intent

✅ Primary CTA clearly highlighted

❌ Multiple CTAs caused decision fatigue

✅ Simplified screen with focused actions

❌ Member selection forced upfront

✅ Clear support options via TIA and help panel

✅ Guided, step-by-step journey introduced

❌ Cluttered screen with too many input fields upfront

❌ Overwhelming form-like experience

✅ Intent-based entry with plan type upfront

✅ Cleaner layout with primary action and visual hierarchy

✅ Plans simplified with clear naming and key benefits upfront

❌ Premium info scattered and visually heavy

❌ Overloaded UI with multiple CTAs (e.g., “Compare”, “Proceed”, “View All Covers”)

✅ Added short explainer videos and focused comparison options

✅ Progress indicator added to show journey stage

❌ Multiple questions at once increase make it overwhelming for the users

❌ Overloaded UI with multiple CTAs (e.g., “Compare”, “Proceed”, “View All Covers”)

✅ Contextual help icon with reassurance messaging (e.g., claim accuracy stat)

Visit Page

📈 Post-launch Validation

Quantitative Metrics

Tracks user behavior at scale — drop-offs, time spent, click-throughs, conversion rates — to establish baseline performance and surface friction points.

Qualitative Feedback

Provides heatmaps, scroll tracking, session replays, and quick surveys to capture how users interact with the new journey and where attention or confusion lies.

Behavioral Validation

Live 1:1 sessions will help us understand user mindset, navigation ease, and clarity of plan comprehension — validating the design at a human level.